Who are Liquidity Providers in Forex?

A liquidity provider, in simple terms, acts as the powerhouse of prices, always showing bid and ask quotes, creating a dynamic environment for traders to thrive. In the forex market, liquidity providers facilitate the buying and selling of currencies by offering competitive bid and ask prices.

Liquidity providers in the forex market, like banks, hedge funds, and market-making firms, actively offer bid and ask prices to facilitate trading and ensure smooth and efficient market flow. By providing liquidity, they also create an ideal environment for traders to make their moves and seize opportunities easily.

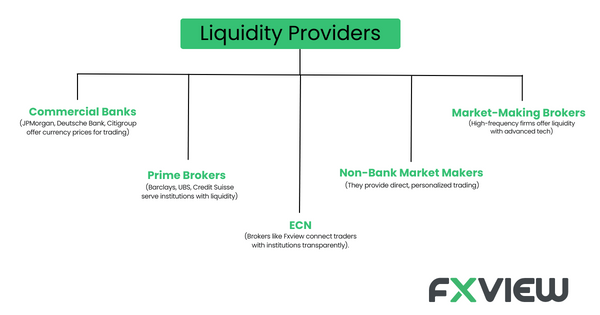

Examples of Liquidity Providers in Forex

- Commercial Banks: Picture those big players like JPMorgan Chase, Deutsche Bank, and Citigroup rocking the scene. These banks give prices for buying and selling currency pairs. They keep the beats flowing and facilitate trading for all market participants.

- Electronic Communication Networks (ECNs): ECN brokers act like bridges in Forex trading. They connect you, the trader, directly with big financial players, like banks. This way, you get to trade directly with these large institutions, ensuring transparency and smoother transactions. For example, Fxview offers traders direct access to the interbank market through its ECN model, allowing for transparent and efficient trading conditions.

- Prime Brokers: Step into the VIP zone with prime brokers like Barclays Prime, UBS Prime, and Credit Suisse Prime. They’re an exclusive group serving big clients like hedge funds and large companies. These prime brokers open the doors to deep liquidity pools and rock those killer prices.

- Non-Bank Market Makers: Get ready for some cutting-edge action from the non-bank market makers. We’re discussing HFT firms and trading companies. They’re not banks, but they make a big impact. Armed with advanced algorithms and technology, they provide liquidity and tighten those spreads like nobody’s business.

- Market-Making Brokers: A market-maker broker doesn’t just connect you to the trading market, but they create an internal market for their clients. Think of a market maker broker as your friendly neighborhood shopkeeper. Do you want to trade Forex? Go ahead! You buy from and sell to them directly at prices they set. It’s simple and personal, and there’s no middleman. So, you get to trade, they make a little on the side, and everyone’s happy.

So, whether it’s the commercial banks, tech-driven ECNs, prime brokers, non-bank market makers, or market-making brokers, these liquidity providers set the stage for a sensational forex experience. They keep the liquidity flowing, and prices tight, and ensure everyone gets their chance to dance. Let’s hit the floor and trade like trendsetters!

Benefits of Liquidity Providers in Forex Trading

- Deep Liquidity: Liquidity providers keep the party going with a constant flow of liquidity in the forex market. No matter the trade size, they ensure you can execute your orders swiftly at competitive prices.

- Tight Spreads: Liquidity providers battle it out to offer you the tightest bid and ask prices, resulting in narrower spreads. This means lower transaction costs for you, making it super cost-effective to enter and exit positions.

- Price Transparency: Liquidity providers keep it real by displaying real-time bid and ask prices. You’ll always know the current market rates, helping you decide like an expert.

- Order Execution: It’s all about smooth moves and flawless execution. Trading with liquidity providers gives you better trading tools and setups. Say goodbye to order slippage and hello to precise execution at the prices you intended.

- Less Market Impact: Liquidity providers take the lead in absorbing a significant chunk of market orders. This means that when you execute those large trades, they won’t cause drastic price swings. It’s a favorable situation for you and the market, giving you more freedom.

- Market Stability: They help by ensuring steady prices and reducing wild price swings.

- Diverse Trading: With liquidity providers, you get many currency options to mix up your trades and keep things fresh.

When selecting a liquidity provider in forex, several factors should be considered

- Reputation: Go for a liquidity provider with a stellar reputation. Look out for well-known financial institutions that have a solid track record of trustworthiness and integrity.

- Liquidity Offering: Check out if they are offering a wide range of currency pairs? How deep is their liquidity? And of course, are their prices on point? Look for providers with competitive spreads and executions that make you go, Wow!

- Technology and Infrastructure: Choose a liquidity provider with top-notch technology and a smooth trading platform. Make sure their systems can handle high trading volumes efficiently and without issues.

- Risk Management: Safety first! Find a liquidity provider that knows how to handle risks like a pro. They need good plans to manage risks, keep an eye on the market, and deal with surprises.

- Support and Service: Find a liquidity provider with responsive customer support. They should be ready to help you quickly and resolve any technical issues or trading questions with a positive attitude.

- Regulatory Compliance: Keep it legit! Make sure the liquidity provider you choose is regulated by respected financial authorities. This means they play by the rules and look out for you. After all, it’s about trading safely.

How does a liquidity provider earn money?

Liquidity providers in forex make money through various mechanisms inherent in their role as market participants. Here are some ways liquidity providers generate revenue:

- Bid-Ask Spread: They work their magic with the bid-ask spread, pocketing the difference between buying and selling prices. With tighter spreads than regular traders, they make profits from the sweet spot in between. By offering competitive spreads, they bring in more traders and keep the money moving.

- Order Flow and Trading Volume: They benefit from the continuous flow of orders and trading volume in the market. As the market moves and orders flow, liquidity providers ride the wave and earn their share. They take a slice of each trade through transaction fees or commissions. The more trading action, the more cha-ching for them.

- Market Making: They play the market like a symphony, buying and selling currencies strategically. They make money from quick price changes and when there’s more buying than selling. By keeping the market flowing, they grab chances and earn more.

- Volume-Based Incentives: They may negotiate volume-based incentives with brokers or trading platforms. These incentives can include rebates or fee reductions based on the trading volume generated by the liquidity provider. By incentivizing higher trading volumes, liquidity providers get a chance to earn more.

Conclusion

In the mesmerizing world of forex trading, liquidity providers shine as the stars that keep the show running smoothly. With good prices, quick trades, and value-added services, they make the market stable and help traders do well.

As the saying goes, “In forex trading, liquidity providers are the life of the party, making profits rain and keeping the dance floor moving!”

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.