What is Forex Trading?

Forex, or foreign exchange, can be simplified as an act of buying and selling currencies from different countries all over the world. Towering over all others with a colossal daily forex trading volume of over $7 trillion, the Forex market is the Goliath of financial markets. Can you imagine? It is so massive that the New York Stock Exchange (NYSE) looks like just a tiny lemonade stand in comparison! Pretty wild, isn’t it?

How Does Forex Trading Work?

Have you ever traded cards with your friends? Well, it is kind of like that. Instead of cards, you exchange different currencies worldwide, like dollars, euros, etc. It can be exciting, however, it can also be risky. I mean, you wouldn’t wanna trade your favourite card for something that might not be worth as much, would you?

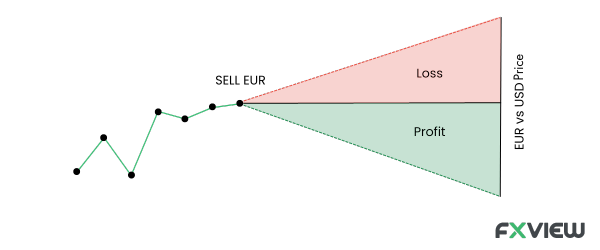

Imagine this: you’re a savvy Forex trader, and you’re eyeing the EUR/USD at 1.1500. And you’ve got information that the US dollar will strengthen against the euro, so you decide to make your move and buy 10,000 euros for 11,500 US dollars. A few days later, the exchange rate rose to 1.1800. Feeling pretty pleased with yourself, eh? You decide to close the position and sell the euro back, ending up with 11,800 US dollars in your pocket, netting a sweet profit of 300 US dollars! However, you need to keep in mind the fact that if the market moves against you, your trade will suffer losses instead of 300 US dollars.

Benefits of Forex Trading

- For one, the Forex market is highly liquid meaning you can easily buy and sell currency pairs whenever you want. You have the freedom to adjust your positions whenever you want, without getting stuck at a certain rate.

- Plus, would you be surprised to know that it can fit right into your schedule? Surprise, it’s open 24/5 (well, not on weekends! So, whether you are an early bird or a night owl, the forex market is open for you to trade whenever it suits your schedule. However, always check the trading hours as some markets may have a recess.

- Lastly, the forex market is highly volatile, which means you have plenty of opportunities. Never a dull moment in the world of trading!

Risks of Forex Trading

The Forex market is like a never-ending adventure, with thrilling highs, and nerve-wracking lows, full of excitement, and opportunities – Okay, let’s stop right there!

Forex trading is very speculative and includes a substantial amount of risk. Therefore, you should always consider whether you can afford to take the high risk of losing your money. The volatility level of the forex is so high, that the price can fluctuate without any warning. If trading were a sport, it would be like the Olympics of finance- fast-paced, high-stakes, and only for the most dedicated athletes (ahem, traders).

Key Takeaways

- Forex trading involves buying and selling currencies from different countries in the foreign exchange market.

- Due to its $7 trillion daily trading volume, forex is the most liquid market across the globe.

- Currencies are always traded against each other to form an exchange rate pair, such as EUR/USD which represents a currency pair for trading the euro against the U.S. dollar.

- Having high liquidity, being able to trade 24/5, and of course, the opportunities on the market are a few reasons why traders like to trade in forex.

- It is very speculative in nature and includes a substantial amount of risk.

Conclusion

The forex market is always moving, and it’s like a rollercoaster ride for traders. You can make money when currency rates change in your favor, but be ready for losses too, as the market can be pretty wild. One cool thing about Forex is that it’s open 24/5, so you can trade whenever suits your schedule. Just remember, it’s not a walk in the park; you’ve got to understand it well and be careful with your moves.

In the next topic, we will talk about the history of the forex – how it went from bartering to modern global currency trading. Sounds exciting, isn’t it?

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.