What is a Swap Rate? 5 Things You Need to Know

In the foreign exchange market, currencies interact dynamically, driven by market forces and speculation. Amid this activity, an understated factor can cause unexpected problems for the unprepared–Swap Rate.

So whether you’re a seasoned trader or just starting out, don’t hesitate to put your trader’s curiosity to use and learn all about “what is a swap rate?” and “how does it work?” In this article:

Table of Contents

- What is a Swap Rate?

- Factors Influencing Forex Swap Rate

- Significance of Swap Rate in Forex

- Swap Rate’s Influence on Trading Strategies

- Disadvantage of a Swap Rate/Rollover Rate

- Key Takeaways

- Conclusion

What is a Swap Rate?

A Swap Rate, also known as overnight interest rate or rollover rate is based on the concept of a “swap” which in forex is the temporary exchange of one currency for another.

When traders engage in forex trading, they essentially borrow one currency to buy another. Hence a swap rate is the interest paid or earned for maintaining a currency position overnight.

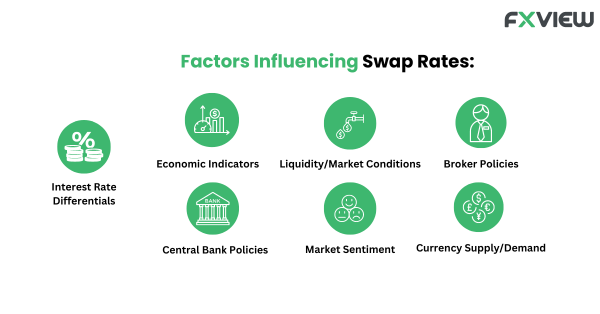

Factors Influencing Forex Swap Rate

- Interest Rate Differentials: A primary determinant is the difference in interest rates between the two currencies in a currency pair. Higher interest rate differentials typically result in higher rates. While lower interest rate differentials might typically result in lower rates.

- Central Bank Policies: Monetary policy decisions by central banks, including changes in interest rates, monetary stimulus measures (such as quantitative easing), and forward guidance, can directly impact these rates.

- Economic Indicators: Key economic indicators, such as inflation rates, GDP growth, employment figures, and consumer spending, can affect these rates also. Strong economic data may lead to expectations of tighter monetary policy, potentially raising these rates, while weak economic data may have the opposite effect.

- Market Sentiment: Market sentiment and risk appetite can influence swap rates. During periods of risk aversion, investors may seek safe-haven currencies with lower interest rates, which may lead to lower these rates for those currencies. Conversely, during risk-on environments, investors may favour higher-yielding currencies, resulting in higher swap rates.

- Liquidity and Market Conditions: Liquidity conditions in the forex market can impact these rates. Thin liquidity or market disruptions may lead to temporary spikes or volatility in these rates. Additionally, changes in market conditions, such as geopolitical events or unexpected news developments, can affect swap rate expectations.

- Currency Supply and Demand: Supply and demand dynamics for currencies can influence swap rates. As higher demand for a currency may lead to lower rates, since investors are willing to accept lower returns to hold that currency. Conversely, lower demand may lead to higher rates.

- Broker Policies and Funding Costs: Individual broker policies and funding costs can also affect them. Brokers may adjust them based on their funding costs, risk management practices, and other factors. Traders should be aware of their broker’s swap rate policies and any adjustments made to them.

Significance of Swap Rate in Forex

- Cost of Overnight Positions: These rates impact how much it costs to keep trades open overnight. If a trader holds onto a trade after the trading day ends, they might either pay a fee or earn a surplus, based on the difference in interest rates between the currencies being traded.

- Impact on Trading Benefits: They can significantly impact a trader’s overall benefits, especially for positions held for extended periods. Positive swap rates may contribute to surplus for traders holding positions in the direction of the currency pair with higher interest rate, while negative rates may add to losses.

- Consideration in Trading Strategies: They play a vital role in shaping trading strategies. Traders may strategically choose currency pairs based on their swap rate expectations, aiming to capitalise on positive rates while minimising exposure to negative rates. Additionally, these can influence decisions regarding the timing and duration of positions, aligning with interest rate cycles or economic events.

- Risk Management: Awareness of swap rates is essential for effective risk management. Traders need to consider potential swap costs or surplus when assessing the risk-reward profile of their trades. Incorporating swap rate considerations into risk management strategies may allow traders to more accurately evaluate the true cost of holding positions and adjust their position sizes or leverage accordingly to manage risk exposure.

- Long-Term Investment Considerations: For long-term traders, a swap rate becomes particularly relevant. Positive rates may contribute to the overall return on investment for positions held over extended periods, potentially offsetting other trading costs and enhancing profitability. Conversely, negative rates may detract from long-term returns and require careful evaluation when planning investment strategies.

- Broker Selection and Comparison: Traders may consider these when selecting a forex broker or comparing offerings across different brokers. Variations in swap rate calculations, rollover policies, and fees can impact the overall trading costs and attractiveness of a broker’s services. Traders may prioritise brokers offering competitive rates and transparent policies to optimise their trading experience.

Swap Rate’s Influence on Trading Strategies

- Carry Trade Strategy: The well-known carry trade strategy, in which traders try to profit on interest rate differentials, heavily relies on swap rates. Traders might be able to maximise their carry trading positions by comprehending and utilising them.

- Long-Term Positioning: When taking a long-term approach to trading, traders must take them into account. Since these rates have a major effect on a position’s overall profitability over time.

- Swap Trade: This involves executing trades specifically to profit from these rates. In a swap trade, traders may take advantage of positive rates by holding positions in currencies with higher interest rates, aiming to earn swap surplus. Conversely, they may seek to avoid or mitigate negative rates by avoiding positions in currencies with lower interest rates or by hedging their positions.

Disadvantage of a Swap Rate/Rollover Rate

- Complexity for Beginners: It might be challenging for new traders to understand and incorporate these rates into their trading methods. For people who are familiar with forex trading, the complexities of interest rate differentials and their effects on profitability may provide difficulties.

- Interest Costs: When traders keep positions in currencies with lower interest rates, they may have to pay interest. Profits may be reduced by negative swap rates, particularly if a trader holds a position for a long time.

- Not Suitable for All Strategy: Not every trading strategy will have the same objectives as swap rates. Their influence may not be great enough for some short-term traders or those using particular tactics to justify consideration.

Key Takeaways

- A Swap rate is based on the concept of a swap in forex and is the interest paid or earned for maintaining a currency position overnight.

- There are several factors that may influence it like, central bank policies or economic indicators.

- From overnight trading costs to its role in risk management, there are many ways that a swap rate can positively influence trading. Conversely, it’s important to acknowledge that alongside these positive effects, these rates can also introduce negative implications, affecting trading dynamics and risk exposure.

- They also impact trading strategies as traders may consider these rates while carry trading and long-term positioning.

Conclusion

Swap rates are more than just numbers on a screen—they’re the hidden costs and benefits that can significantly impact your forex trading journey. By understanding them you may be able to navigate the forex trading with greater confidence and make better-informed decisions.

Disclaimer: The information in this article is provided for educational and informational purposes only and is not intended to be, nor does it constitute financial, investment, or trading advice. You should not make any financial, investment, or trading decisions based on the information provided in this article without performing your research or seeking advice from an independent advisor.