Forex Rollover Rate for Smart Trading

Looking to step up your forex trading game? Then you might want to grow your understanding about Forex Rollover Rates. Keep following along to know how they function, along with some handy trading suggestions. Let’s jump in and get to know them better!

What is the Rollover Rate in forex?

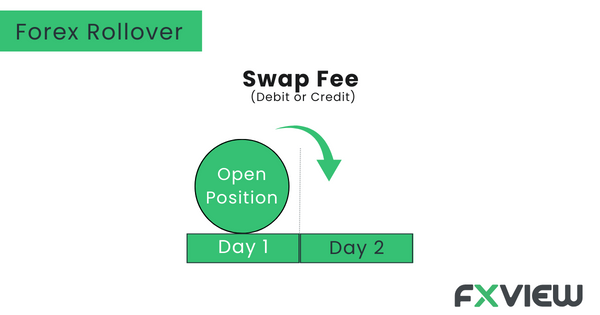

In Forex, rollover refers to extending the settlement date of an open position to the next trading day. When you hold a Forex position overnight, you may incur or earn an interest rate differential on the involved currency pair. Knowing this might help you control your costs and what you could earn.

Let’s understand:

- Overnight Positions: When you hold a position beyond the trading day, it becomes an overnight one, and that’s when it kicks in.

- Interest Rate Differential: It involves adjusting the interest rates between the currencies in a currency pair. Every currency has an interest rate, decided by its central bank. The difference between these rates determines the interest rate differential.

- Positive or Negative Rollover: Positive rollover occurs when a trader benefits from holding a currency pair overnight due to the higher interest rate of the currency being bought, while negative rollover happens when a trader has to pay interest because the currency being bought has a lower interest rate.

- Crunching the Numbers: Amounts are usually calculated based on your position size and the interest rate differential. Just remember, it can vary between brokers and may be adjusted based on market conditions.

- Timing is Key: It usually hits around 5 pm Eastern Time (ET) when the trading day ends. It’s at this moment that open positions are rolled over to the next trading day, and interest rate adjustments come into play.

- Impact on Costs: These rates directly impact the cost of holding positions overnight. Positive rates can cover costs or add to your earnings, but lower ones can cost you more. Remembering this helps you trade smarter.

- Swap Rate: Sometimes, you’ll hear the term “swap rate” used instead of it. They mean the same thing – the interest rate differential applied to positions in Forex trading.

That’s the lowdown. Knowing how rollover rate functions helps you handle night trades and make choices that fit your trading aims.

Calculation for Rollover Rate

Let’s consider an example using EUR/USD, where the exchange rate is 0.75. The interest for EUR is 1.5%, and for the USD, it’s 2%.

Rollover rate = (Interest rate of EUR – Interest rate of USD) / 365 * exchange rate.

In our example, the rollover rate for holding USD by borrowing EUR overnight would be:

(1.5 – 2) / 365 * 0.75 = -0.5 / 273.75 = 0.001826%.

Tips for Maximizing your Forex Trading with Rollover Rate

- Master Rollover Rates: Grasp the ins and outs of how they are calculated and how they can sway your trading positions. Understand the role of interest rate differentials in determining positive or negative outcomes.

- Check Your Broker’s Policy: Each broker has its own policies and rates. Familiarize yourself with your broker’s terms and conditions regarding them. Don’t hesitate to compare rates between brokers to ensure you’re getting the most competitive ones.

- Monitor Economic Calendar Events: Stay in the loop with economic calendar events that have the potential to sway interest rates. Bank meetings, policy news, and economic updates can change rates and thus affect your trading.

- Stay Informed: Stay updated and be ready for any changes. Knowing more helps you trade smarter.

- Incorporate into Your Strategy: Factor them into your overall trading strategy to optimize profitability. If you’re holding positions for an extended period, take associated costs into account when analyzing potential trade setups.

- Stay Aware of Market Conditions: Stay alert to market conditions that can influence them. Market ups and downs, geopolitical events, and policy changes can change interest rates, affecting your approach. Adapt accordingly by staying updated on the latest market news.

- Utilize Calculators: Many forex brokers offer handy calculators or tools that allow you to estimate potential costs or earnings for specific currency pairs and position sizes. Use these tools to prepare and see how they might affect your trading.

- Tailor Your Trading Style and Holding Period: If you’re an active day trader who closes positions before the rollover time, they may not significantly affect your trading. However, if you tend to hold positions for longer durations, associated costs or earnings become more substantial. Adjust your trading style and holding periods accordingly.

Keep in mind, that knowing how to use them can really help in forex trading. With these tips, you’ll be ready to handle them and make smart choices.

Conclusion

Rollover rate matters in forex trading. Understanding them helps control costs and see possible earnings. So, stay in the loop, plan your trades strategically, and keep those rates in mind to level up your trading game and make informed decisions. Stay updated, plan smart, and use it in your trades.

Disclaimer: The information in this article is provided for educational and informational purposes only and is not intended to be, nor does it constitute financial, investment, or trading advice. You should not make any financial, investment, or trading decisions based on the information provided in this article without performing your own research or seeking advice from an independent advisor.