Learn the ABCs of Forex Currencies: Major, Minor, and Exotic!

Hello, curious brains! We’re going to focus on Major, Minor, and Exotic currencies as we set out on a delightful journey into the world of Forex trading today. We’ve just touched the surface so far; now it’s time to learn everything there is to know about these different types of currencies. This information will improve your decision-making skills, which will aid you in becoming an effective Forex trader.

Major Currencies: The Big Shots

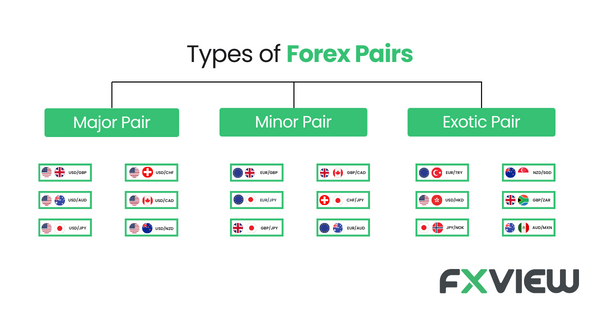

You’ll hear the phrase “major currencies” a lot when trading on the Forex market. These currencies are the big players, representing the most traded currencies worldwide. They originate from countries with robust economies, making them the cornerstone of Forex trading. Let’s take a closer look at some of the currencies that dominate the scene:

- US Dollar (USD): Often called the “Greenback,” it’s the world’s top currency for global trade and a big deal in financial markets.

- Euro (EUR): If you’re in Europe, this is your currency. It’s the second most traded currency and important in Forex.

- British Pound (GBP): The Pound is from the UK and is known for stability. Many forex traders like it.

- Japanese Yen (JPY): Japan’s currency, the Yen, is unique with low interest rates.

Why care about these major currencies? They’re like the rockstars of Forex – easy to buy and sell, and usually stable. If you’re new to Forex, these are your reliable choices.

Minor Currencies: The Underdogs

Moving on to “Minor currencies,” these are still vital players in the Forex market, but they’re not as heavily traded as these currencies. They often represent countries with substantial economies, but not to the extent of the one discussed above. Here are a few examples of these currencies:

- Canadian Dollar (CAD): Known as the “Loonie,” it dances with oil prices. Interesting for those watching energy markets.

- Australian Dollar (AUD): The “Aussie Dollar” depends on Australia’s exports and reacts to global commodity prices.

- New Zealand Dollar (NZD): The “Kiwi Dollar” is like the Aussie Dollar’s cousin and reacts to commodity price changes too.

These minor currencies can be less predictable but offer chances for smart traders because they can be more volatile.

Exotic Currencies: The Risk-Takers’ Playground

Lastly, let’s venture into the world of “Exotic currencies.” These are the currencies of smaller or developing countries, which can offer an exciting and unpredictable trading experience. Examples of these currencies include:

- Turkish Lira (TRY): This represents Turkey and is super volatile. Brings in traders who want to take big risks for big rewards.

- South African Rand (ZAR): South Africa’s Rand moves with things like mining and commodity prices.

- Brazilian Real (BRL): Brazil’s currency, the Real, is influenced by economic and political events. It’s exciting for traders.

Trading exotic currencies is like an adventure because they’re not traded as much as the big ones. They can change in value dramatically.

Conclusion

We have covered Forex and the many sorts of currencies in this guide. Your ability to master these currencies and to develop a plan that fits your objectives and risk tolerance will determine how successful you are in the forex market.

Whether you opt for major currencies, seeking safety and stability; minor currencies, pursuing a touch of excitement; or exotic currencies, craving the thrill of the unknown, always remember that the Forex market is a constantly shifting landscape.

To thrive in this dynamic environment, it’s crucial to remain committed to learning, stay well-informed about market trends, and exercise prudence when managing your risks. As you embark on your Forex journey, I extend my best wishes for your success. May your trading endeavors be filled with wisdom, profitable opportunities, and a rewarding experience!

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.