Understanding the Long and Short Position in Trading

Forex trading or foreign exchange market is like setting out on an exciting adventure. Like any journey, you’re likely to encounter unfamiliar language and concepts. At the heart of this vast ocean of currency trade are two foundational concepts: the “long and short position in trading.” If you’re keen on decoding this world, let’s set sail!

Setting the scene: Welcome to Forex!

Imagine a bustling global marketplace where currencies dance with each other. Pairs like the EUR/USD (where the Euro takes the lead as the “base currency”) form the essence of the Forex stage. Every time a trader believes in the upward or downward movement of these pairs, they usually choose between taking a long or short position in trading.

Long and Short position in trading

Diving into the deep: What does “Going Long” really mean?

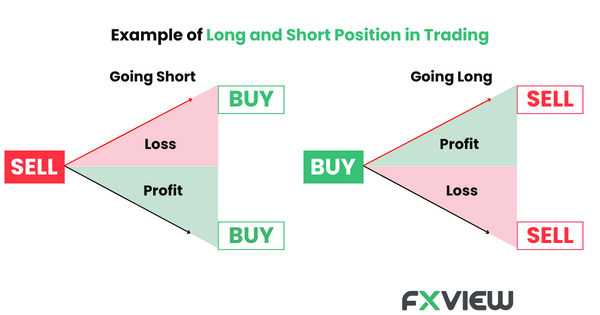

- Long Position: Think of the long position in trading as your vote of confidence in a currency’s future performance. If you’re feeling buoyant about a currency’s prospects, you may go long, hoping to buy it now and potentially sell it at a more lucrative rate later.

- For Instance: Your research suggests that the Euro is gearing up for a rally against the US Dollar. With this optimism, you may decide on a long position in the EUR/USD pair. If your instinct aligns with the market movement, and the Euro surges, you might be in a position to capitalize on this understanding of the long and short position in trading.

Sailing against the tide: Embracing the “Short” Strategy

- Short Position: The realm of the long and short position in trading is balanced. The short position is the Yin to the Long’s Yang. When the market clouds hint at a potential currency storm or decline, traders might opt for a short position. They may aim to sell now, forecasting a chance to buy back at a lesser value later.

- For Instance: You’ve been poring over the latest financial updates, and something indicates that the US Dollar might outshine the Euro soon. Acting on this hunch, you can embrace a short position in the EUR/USD pair. Should the Euro take a dip, this strategic play on the long and short position in trading could pay off.

Navigating the Market: Tips and Warnings for Your Trading Journey

- Risk Management: All journeys have their perils. Trading is no different. When steering through the long and short position in trading, always have your risk compass handy to make informed decisions.

- Leverage’s Double-Edged Sword: With leverage, small waves can feel like tidal surges. It may boost potential gains but can equally intensify losses. Tread with care and always take into consideration if you can afford the potential losses.

- Reading the Stars (Market Analysis): Before anchoring on a long or short position in trading, scan the skies. Dive into technical charts, and keep an ear out for global news; they’re your guiding constellations.

- Night’s Toll (Swaps and Overnight Interest): Holding a long or short position in trading as night falls? Be ready for the night’s toll, which could either potentially credit or debit your account based on the interplay of interest rates.

Your Trading Guide: Understanding Market Directions

“Bullish” is when the trading winds favour a rise in currency value, driving you towards a long position in trading. In contrast, “bearish” breezes suggest a descent, nudging you towards a short position in trading. Remember, in the Forex seas, these aren’t tangible transactions but rather contractual commitments.

Your treasure map’s key insights

- Knowledge Anchors: Strengthen your journey by mastering the basics of Forex, including the details of long and short trading positions.

- Balancing Rewards and Risks: While the potential of benefits might be enticing, be vigilant of the hidden dangers and risks and always consider whether you can afford losses.

- Learning’s Endless Horizon: The horizon keeps shifting. Stay updated. Keep updating your trader’s logbook.

- Sages’ Council: Before you set sail on any trading adventure, a quick chat with the old sea dogs (financial experts) could save you from many storms. However, you should perform your own research and visit educational materials available online in order to make informed decisions.

Conclusion

Understanding the nuances of the long and short position in trading can be your guiding star in the vast Forex seas. With the right plan, ongoing learning, knowledge and risk management, you can navigate this forex market with more confidence.

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment, or trading advice. You should not make any financial, investment, or trading decisions based on the information provided in this article without performing your own research or seeking advice from an independent advisor.