Market Sentiment Indicators- An Ultimate Guide!

Remember our thrilling exploration of Sentiment Analysis? Well, just as promised, here’s a detailed dive into market sentiment indicators, which may assist you with your trading vessel. Fasten your seat belts, as we’re about to embark on an exhilarating journey through the land of forex sentiment and the tools that may help us gauge it!

What is a Market Sentiment Indicator?

Imagine you’re a captain of a ship, and the vast forex market is your ocean. Sentiment indicators are like the weather vane and compass combined – they may show you where the wind (or sentiment) is blowing and how strong the currents (market trends) are. These indicators may help you read the collective mood of investors and traders. It is important to be able to make informed decisions in the trading world, therefore understanding the market sentiment indicators could be a helpful tool, whether you’re sailing with the current or daringly going against the tide!

Market Sentiment Indicators: A Deeper Dive

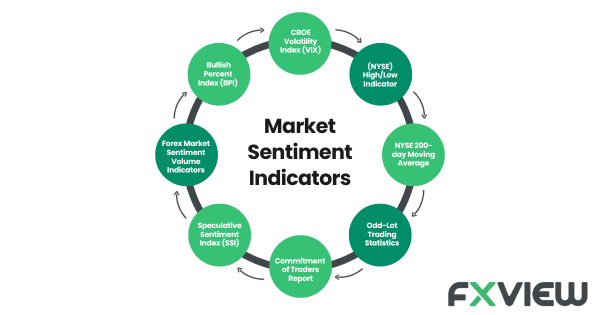

- CBOE Volatility Index (VIX): Often called the ‘fear index’, the VIX may reflect the market’s expectation of volatility over the next 30 days. When the seas are stormy, and traders are fearful, the VIX climbs. Conversely, on calm sunny days in the forex sentiment world, it drops.

- New York Stock Exchange (NYSE) High/Low Indicator: Like the highs and lows of ocean waves, this indicator tallies the number of stocks hitting 52-week highs against those hitting 52-week lows. A rise in the former suggests bullish sentiments, whereas a dominance of the latter indicates bearish tendencies.

- NYSE 200-day Moving Average: This is your telescope, giving you a broader view of the market’s trajectory. By charting the average closing prices over 200 days, it can reveal whether the general sentiment analysis in forex is potentially bullish (when current prices are above this average) or bearish (when they’re below).

- Odd-Lot Trading Statistics: Remember the small fish in the big ocean? Odd-lot traders (those trading less than 100 shares) may represent the less experienced. Tracking their activities might give insights into what the retail market segment is feeling.

- Commitment of Traders Report: A treasure map of the forex sentiment indicators, this weekly report can unveil the activities of different trader classifications. It’s like peeking into the logbooks of other ship captains!

- Speculative Sentiment Index (SSI): This sentiment indicator is unique to the forex market. The SSI can give us a ratio of buyers to sellers. An overabundance of buyers might indicate an overbought condition, and vice versa.

- Forex Market Sentiment Volume Indicators: Volume speaks volumes! These indicators can measure the number of trades in a security. Rising volume may validate a price trend, making it an important ally in interpreting market sentiment.

- Bullish Percent Index (BPI): The BPI can measure the percentage of stocks in a sector with bullish patterns. A high BPI may indicate strong positive sentiments, while a low one can hint at prevailing negative vibes.

Conclusion

Understanding market sentiment indicators is like mastering the art of sailing in tricky waters. While the currents of market sentiment can be challenging to navigate, with the right tools, you may be able to indicate potential opportunities and make informed decisions. However, you should always keep in mind that the market is volatile, and unexpected events may occur which could lead to potential losses.

As you begin or continue your trading journey, remember that the market’s mood can change like the wind. But equipped with the knowledge of sentiment analysis in forex and market sentiment indicators, you may be able to take advantage of the market and set sail, whether the waters are calm or stormy.

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment, or trading advice. You should not make any financial, investment, or trading decisions based on the information provided in this article without performing your own research or seeking advice from an independent advisor.