How to use the Bat Pattern in trading?

The tapestry of trading is replete with patterns, clues, and signals. Within this rich mosaic, a particular shape stands out– the bat pattern in trading. No, it’s not about our nocturnal avian companions; rather, it’s a trading tool to potential market movements. Dive into this exploration of the bat pattern in trading, as we navigate its essence, nuances, and strategies.

Understanding the Bat Pattern in Trading

In the orchestra of trading, where every note can indicate at what’s next, the bat pattern may play a pivotal melody. This harmonic pattern is like that unexpected twist in a story, indicating potential market reversals. Picture a dance floor where the bat pattern is that breathtaking spin, leaving everyone agape just when they thought they had seen it all!

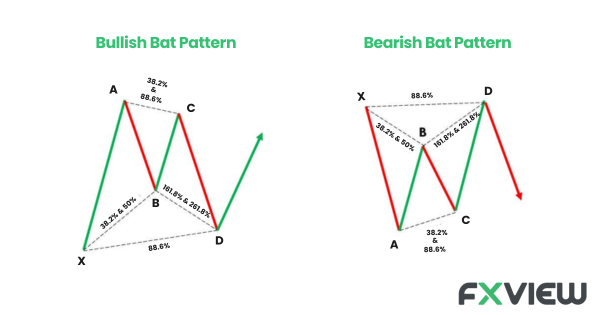

The Dance of the Bearish Bat

Hinting at potential price dips, the bearish bat pattern may emerge like a cliffhanger. It usually dances its way in after a notable upward crescendo, indicating that the market might just be preparing for a brief intermission. When this pattern surfaces, it feels as if the market is indicating a looming storm or, at the very least, a change in tempo.

The Tune of the Bullish Bat

Contrastingly, the bullish bat pattern in trading is the harbinger of potential optimism. Evident after a downward drift, it’s akin to that uplifting bridge in a song, indicating a potential climax. This pattern feels like the gentle warmth breaking through a cloudy sky, signaling traders that a melodious high note might potentially be approaching.

Decoding the Harmonic Rhythms of the Bat Pattern

Harmonic Patterns, including our star–the–bat pattern, sing to specific rhythms:

X: The starting point

A: The end of XA and the start of AB

B Point: Should touch either the 38.2% or 50% retracement of the XA leg.

C Point: Ranges between 38.2% to 88.6% of the AB stretch.

D Point: Swings from 161.8% to 261.8% of the BC movement, simultaneously spanning 88.6% to 100% of the XA stride.

Understanding these rhythms may assist traders remain attuned to the true song, not mistaking it for mere background noise.

Finding the Perfect Tempo: Timeframes for the Bat Pattern

Though the bat pattern in trading can appear in various tempos (timeframes), its essence resonates clearer in extended compositions. It’s akin to appreciating a full song rather than just its hook. Hence, in forex, charts spanning daily to 4-hour intervals often strike a relative chord with seasoned traders.

Navigating the Bat Pattern Symphony

Unearthing the bat pattern is a blend of art and science. It’s about recognizing the X, A, B, C, and D notes and assisting with staying true to the harmonic rhythms highlighted earlier. Modern tools, like software with harmonic indicators, can be instrumental in this quest.

Understanding the Art of Bat Pattern in Trading

- Locate & Validate: Begin by distinguishing either a potential bullish or bearish bat rhythm.

- Initiation: For a potentially upbeat (bullish) bat, think about initiating a potential purchase near the D’s conclusion. For its somber (bearish) counterpart, a potential selling move is a strategy.

- Guarding Against Missteps: Think about positioning the protective stop just beneath point D for bullish or above it for bearish rhythms.

- Target Acquisition: You may set sights on a 61.8% pullback of the AD stretch for the primary aim and 100% for the secondary.

Advantages of Bat Pattern in trading

Bat Patterns in Forex trading are a specific type of harmonic pattern that traders use to predict potential reversals in the market. Here are some advantages of using Bat Patterns in Forex trading:

- High Probability Trades: Bat Patterns are known for their high success rates when it comes to predicting price reversals. When a Bat Pattern is correctly identified, traders can enter a trade with a high level of confidence, increasing the chances of a successful outcome.

- Clear Entry and Exit Points: The Bat Pattern provides clear and precise entry, stop-loss, and take-profit levels. This helps traders in managing their trades effectively, ensuring that they enter and exit the market at optimal prices.

- Risk Management: Due to the clear entry and exit points provided by the Bat Pattern, traders can easily calculate their risk-to-reward ratio, helping them to manage their risk effectively on each trade.

- Versatility: Bat Patterns can be used in various market conditions and on different time frames. Whether the market is trending or ranging, traders can use Bat Patterns to identify potential reversal points.

- Enhanced Technical Analysis: Incorporating Bat Patterns into technical analysis enhances the overall analysis of the market. Traders can combine Bat Patterns with other technical indicators and tools to increase the accuracy of their predictions.

- Improved Trading Discipline: Following the strict rules required to identify Bat Patterns helps in enhancing a trader’s discipline. Traders learn to be patient and wait for the right market conditions to enter a trade, which can lead to more consistent trading results.

- Educational Value: Learning to trade with Bat Patterns requires an understanding of Fibonacci ratios and market geometry. This educational process can enhance a trader’s overall knowledge and skills in Forex trading.

Shortcomings of Bat Pattern in trading

- Demands Sharpness and Patience: Trading bat patterns requires a keen eye and patience. Traders need to be adept at pattern recognition and exercise discipline in waiting for the pattern to fully form before taking action.

- Not Entirely Shielded from False Signals: Like all technical analysis patterns, bat patterns are not foolproof. There is a risk of false signals or patterns that don’t play out as expected, emphasizing the need for confirmation and risk management strategies.

Bat patterns can be a useful tool for traders, offering predictive potential and clear entry/exit points. However, traders must be patient and vigilant in their analysis while being mindful of the possibility of false signals and not solely rely on them to make their trading decisions.

Conclusion

The bat pattern in trading concert is an instrumental harmonic rhythm flagging prospective price shifts. Both its bullish and bearish tunes may indicate impending high notes and lows, respectively. With defined rules and favored tempos, the bat pattern, though demanding, could offer insightful direction. In summation, akin to a guardian watching over a metropolis, the bat pattern stands sentinel over the market, offering traders a beacon in fluctuating times. Embrace the wisdom, understand the rhythm, and let the bat orchestrate your trading opus!

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.