Fundamental Analysis vs Technical Analysis: Which is Better for You?

When it comes to making informed decisions in trading or investing, the debate between fundamental analysis vs technical analysis is ongoing. Both methods have their distinct advantages, and depending on your investment goals, one may be more suitable than the other. In this comprehensive guide, we’ll understand the difference between both fundamental analysis vs technical analysis, compare their strengths and weaknesses, and help you determine which strategy is best suited for your trading style.

Technical Analysis

Technical analysis is a method that focuses on price patterns and trading volumes to predict future market movements. Unlike fundamental analysis, which evaluates the intrinsic value of an asset, technical analysis is purely data-driven. Traders often use this method to determine the best entry and exit points, making it a popular choice among short-term traders.

How Technical Analysis Works

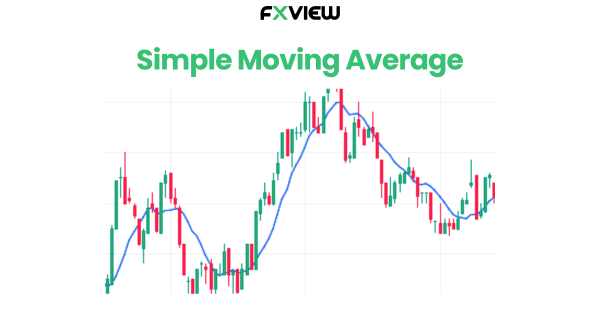

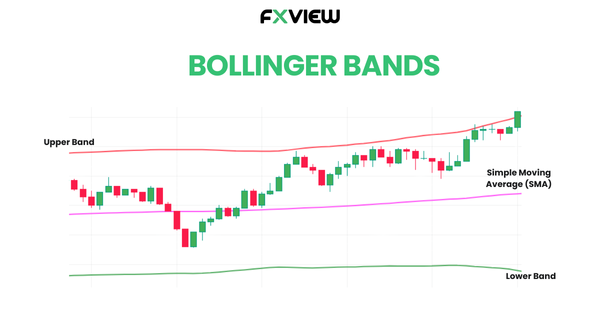

Technical analysis relies on chart patterns and technical indicators to forecast price trends. By analyzing historical price movements, traders identify patterns such as support and resistance levels, moving averages, and momentum indicators, allowing them to predict potential price direction.

Key Tools in Technical Analysis

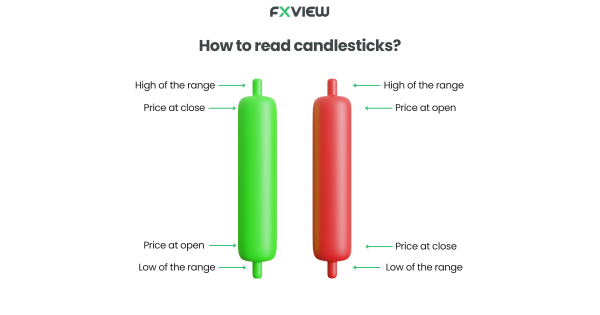

- Candlestick Charts: These represent price movement over a specified time frame.

- Indicators: Popular indicators include the Relative Strength Index (RSI), Moving Averages, and Bollinger Bands.

- Volume Data: Trading volumes are analyzed to understand the strength of a price movement.

Advantages of Technical Analysis

- Timely Decisions: Since it is focused on recent price movements, technical analysis allows traders to react quickly to market changes.

- Suitable for Short-Term Trading: It helps traders capitalize on quick price fluctuations.

- Widely Applicable: This approach can be applied to a variety of markets, including stocks, commodities, and forex trading.

Limitations of Technical Analysis

- Ignores Fundamentals: Technical analysis does not consider a company’s financial health or macroeconomic factors, which are crucial for long-term investments.

- Short-Term Focus: It’s best suited for short-term trades and may not provide a long-term perspective.

- Subjective Interpretation: Different traders may see the same price patterns in various ways, which can lead to different conclusions.

Fundamental Analysis

In contrast to technical analysis, fundamental analysis evaluates the intrinsic value of an asset by examining underlying economic, financial, and industry factors. For stocks, this includes analyzing financial statements, management quality, and industry conditions. For forex, it involves looking at macroeconomic indicators such as interest rates, GDP growth, and inflation.

Key Tools in Fundamental Analysis

- Financial Statements: Balance sheets, income statements, and cash flow statements are key in understanding a company’s financial health.

- Macroeconomic Data: For forex traders, interest rates, inflation, and GDP growth are important.

- Industry Analysis: Knowing industry trends helps evaluate how a company competes in the market.

Advantages of Fundamental Analysis

- Long-Term Focus: Fundamental analysis is ideal for investors with a long-term horizon.

- Comprehensive Insights: It provides a deep understanding of the intrinsic value of an asset.

- Risk Management: By focusing on underlying economic conditions, traders can mitigate risks associated with market sentiment or short-term volatility.

Limitations of Fundamental Analysis

- Time-Consuming: Doing a detailed fundamental analysis takes a lot of time and effort.

- Lagging in Short-Term: It may not be useful for traders looking for short-term gains since it’s focused on long-term intrinsic value.

- Ignores Market Sentiment: Fundamental analysis does not account for short-term market sentiment, which can heavily influence asset prices.

Key Differences Between Fundamental and Technical Analysis

When evaluating fundamental analysis vs technical analysis, it’s important to recognize their key differences:

Focus:

• Technical analysis focuses on price charts, trading volumes, and market trends.

• Fundamental analysis focuses on a company’s financial health, economic conditions, and industry factors.

Time Horizon:

• Technical analysis is usually preferred by short-term traders.

• Fundamental analysis is commonly used by long-term investors.

Data Types:

• Technical analysis looks at past price data and uses various technical indicators.

• Fundamental analysis relies on economic reports, financial statements, and market conditions.

Market Sentiment:

• Technical analysis considers market sentiment by studying price movements.

• Fundamental analysis does not consider short-term sentiment, focusing instead on long-term value.

Which Approach is Better?

There is no one-size-fits-all answer to whether fundamental analysis or technical analysis is better. It depends on your trading style and objectives.

- If you’re a short-term trader, technical analysis will likely be more useful. This method helps in identifying market entry and exit points quickly.

- If you’re a long-term investor, fundamental analysis is more effective in evaluating the intrinsic value of an asset.

For forex traders, the debate over technical analysis vs fundamental analysis forex remains relevant. In this case, combining both methods can often provide a clearer picture.

How to Combine Fundamental and Technical Analysis?

Many traders combine fundamental and technical analysis to gain a better understanding of the market. Here’s how:

- Use Fundamental Analysis to Choose Assets: Start with fundamental analysis to identify strong stocks or currencies. For example, analyze financial statements or key economic indicators to understand whether an asset is undervalued or overvalued.

- Use Technical Analysis for Timing: Once you’ve identified an asset worth investing in, use technical analysis to time your entry and exit points. This helps optimize your trades.

- Stay Informed About Economic Events: Major economic events such as interest rate announcements can significantly impact price movements. Monitoring these events allows you to integrate both fundamental and technical analysis in your decision-making.

How to Trade Using Fundamental and Technical Analysis with Fxview?

Fxview provides advanced platforms for both fundamental and technical analysis!

- Economic Calendars: Fxview offers an economic calendar to keep traders informed about key events that affect markets. Use this to apply fundamental analysis and anticipate market changes.

- Technical Tools: The platform comes with a wide range of technical indicators and charting tools, making it easier for you to apply technical analysis.

- Backtest Strategies: Fxview allows traders to backtest their strategies, combining both methods to evaluate past performance and optimize for future trades.

Key Takeaways

- The choice between fundamental analysis vs technical analysis depends on your investment goals and trading style.

- Technical analysis is well-suited for short-term trading, while fundamental analysis works better for long-term investing.

- Combining both approaches can offer a balanced strategy that maximizes potential gains and minimizes risks.

- Fxview provides tools for applying both fundamental and technical analysis to help you make informed trading decisions.

By understanding the strengths and limitations of both fundamental analysis vs technical analysis, traders can make smarter, more informed decisions. Whether you’re a short-term trader or a long-term investor, knowing when and how to use these methods will enhance your trading performance.

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.