Fundamental Analysis

Navigating financial markets well, demands sharp thinking. Understanding fundamentals can be important for traders, especially in forex where currencies react to global events, making them highly volatile. In this guide, we’ll explore why fundamental analysis matters in forex, break down how it works, and compare it to technical analysis.

Fundamental Analysis Explained

Fundamental analysis in forex trading involves, examining the underlying economic factors that influence the value of currencies. Traders look at various indicators such as interest rates, inflation rates, economic growth, geopolitical events, and central bank policies to determine the strength or weakness of a currency. By understanding these fundamentals, traders may make informed decisions about when to buy or sell currencies, based on the likely impact of these factors on exchange rates.

Understanding the core of Fundamental Analysis in Forex

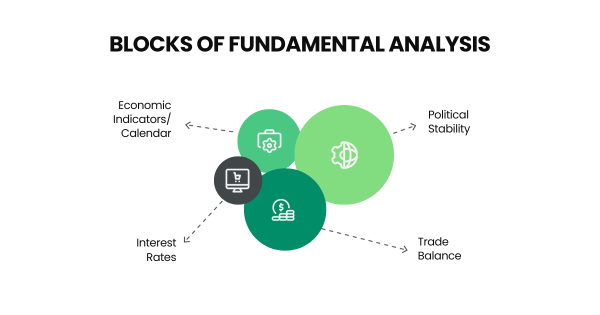

Several key factors are the building blocks of fundamental analysis in forex:

- Economic Indicators: These numbers, like GDP growth, inflation rates, employment figures, and consumer sentiment, hold the power to potentially swing currency values.

- Interest Rates: The decisions of Central Banks on interest rates can make a currency more or less appealing to traders and investors.

- Political Stability: Political events, elections, and geopolitical tensions can create waves of uncertainty that ripple through currency markets.

- Trade Balance: The balance between a country’s exports and imports can either strengthen or weaken its currency.

- Economic Calendar: Think of this as a schedule of economic events – releases of data like employment reports, manufacturing stats, and retail sales figures. Consider it a pre-alert for traders, offering insights into possible storms stirring in the market’s horizon.

Elements of Fundamental Analysis

Fundamental analysis may help traders obtain information about the overall state of the market. Here’s why it’s invaluable:

- Long-term Perspective: Think of it as a glimpse through time’s lens, potentially aiding traders in spotting enduring trends that may stretch across the temporal landscape.

- Risk Management: By understanding the bigger picture, traders may navigate choppy waters with more confidence.

- Market Sentiment: It’s like a mood ring for the market, showing whether a currency could be considered overpriced or a steal.

- Timing Trades: Knowing the true value of an asset could help traders enter and exit the market at opportune times.

Fundamental Analysis – How To?

Embarking on the journey of fundamental analysis resembles deciphering an intricate puzzle with every piece holding a hidden significance.

Here’s an example of an approach :

- Pick a Currency Pair: You may decide which currencies you want to analyze.

- Gather Economic Intel: You may dive into economic indicators – GDP, inflation, employment data, interest rates – for both currencies in the pair.

- Probe Central Bank Policies: Understand what central banks may be up to.

- Probe Politics and Geopolitics: Keep an eye on political events, elections, and global tensions – they can tip the scales of currency values.

- Weigh Trade Balances: Examining the trade balances of both countries in the pair – a trade surplus or deficit may potentially impact currency strength.

- Tune into Market Sentiment: You could get a sense of market mood and analyse predictions to gauge what’s on the horizon.

Fundamental vs. Technical Analysis

Within the realm of analysis, two foundational pillars stand tall: fundamental and technical. They have distinct flavors:

- Data Sources: Fundamental analysis is like studying a nation’s heartbeat – economic data, Central Bank moves, and political climate. Technical analysis, on the other hand, can read the patterns in historical price data and charts.

- Time Horizon: Fundamental analysis might be the compass for long-term decisions, while technical analysis may be the navigator for short-term strategies.

- Decision Making: Fundamental analysis may reveal the essence of an asset’s value, while technical analysis may guide when to hop on or off the trading train based on chart patterns.

Conclusion

With fundamental analysis, you may step into the forex realm armed with insights. Remember, fundamental and technical analysis are like two wings of a bird – both are needed for a smoother flight. However, you should always keep in mind that some events may occur unexpectedly and are difficult to predict.

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment, or trading advice. You should not make any financial, investment, or trading decisions based on the information provided in this article without performing your own research or seeking advice from an independent advisor.