Forex Market Sessions

When it comes to forex trading, timing is everything. With the forex market session opening 24 hours a day, 5 days a week, it’s crucial to know which sessions are the most active and may offer the most trading opportunities. But, let’s be real, with all these different forex sessions, it can feel like you’re on a roller coaster ride. Now, let’s we’ll break down the types of forex sessions. So, strap in, grab your trading snacks, and let’s go!

Tokyo Session

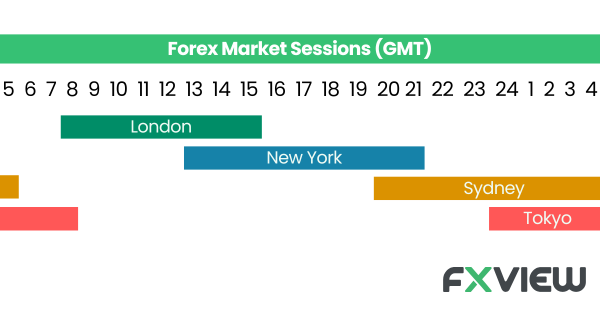

The Tokyo session starts at 12:00 AM GMT (7:00 PM EST) and closes at 9:00 AM GMT (4:00 AM EST). They may be the least popular of the four but don’t underestimate it. This session often sets the tone for the day, as it’s the first major market to open. Traders may expect low volatility and steady trading opportunities during this session.

- Often called the Asian session, this period sees a fusion of actions from major financial hubs like Tokyo, Singapore, and Hong Kong.

- The Yen, being the third most traded currency, saw its highest volume during this session.

- Keep an eye out for economic news from Japan which can be a significant driver of price movement.

- This session is also influenced by the economic data released from China and Australia.

London Session

Next up is the London Session, which overlaps with the Tokyo Session for a few hours. The London session is considered to be the most active forex trading session, as it overlaps with the New York session too. It begins at 8:00 AM GMT (3:00 AM EST) and closes at 5:00 PM GMT (12:00 PM EST). This session can be a bit of a slow climb at first, but once it picks up speed, hold on tight! Traders may expect some wild market swings and perhaps a cup of tea to calm their nerves.

- Often referred to as the European session.

- The London session commands roughly 30-35% of total forex trading volume, making it the world’s largest FX market.

- Major pairs involving the British Pound, Euro, and Swiss Franc see the highest volatility.

- Major economic announcements from the Eurozone can significantly impact the market during this session.

New York Session

The New York session is another forex market session to open and overlaps with the London session. It starts at 1:00 PM GMT (8:00 AM EST) and closes at 10:00 PM GMT (5:00 PM EST). It is the most active session, with the US markets in full swing. This session sees the most liquidity and volatility, with traders looking to jump in and out of positions quickly.

- Referred to as the US or American session.

- The US Dollar, which is a part of nearly 90% of all forex transactions, is most active during this session.

- Key economic data from the US such as Non-Farm Payrolls, GDP, CPI, etc., are released during this session, causing heightened volatility.

- With London still in play, the overlap of these two giant markets can lead to rapid and large movements.

Sydney Session

Last but not least is the Sydney Session, which overlaps with the Tokyo Session for a few hours. It begins at 10:00 PM GMT (5:00 PM EST) and concludes at 7:00 AM GMT (2:00 AM EST). While it may not be as active as the other sessions, the Sydney Session can offer some interesting trading opportunities.

- Also known as the Australian session.

- Apart from the Australian economic data, it’s also essential to keep an eye on China’s economic releases as Australia and China have strong trade ties.

- Pairs involving the Australian Dollar, like AUD/USD or AUD/JPY, can have distinct moves during this session.

Visual Representation of Forex Market Sessions

Key Takeaways

Forex market sessions are like a globe-trotting adventure, with four main stars: Tokyo, London, New York, and Sydney Sessions.

Traders are like globe-trotters, trying to squeeze every last drop of trading action in 24 hours.

These sessions have a knack for playing musical chairs; London takes a seat when New York gets up, and New York dances with Sydney. It’s a 24-hour party, and the market never sleeps!

Volatility in the Forex market can get as jumpy as a caffeinated kangaroo during trading sessions overlap.

Conclusion

To put it simply, getting the timing right in a forex market session is a bit like knowing when to catch those perfect waves at the beach. We’ve got these four forex market sessions – Tokyo, London, New York, and Sydney – and each one has its own style and opportunities. Now, here’s where it gets interesting: when these sessions overlap, that’s when the trading action really picks up. It’s like being out there on your surfboard when the waves are just right – it’s an adrenaline rush and a chance to make some great trades. So, remember to watch the clock, ride those market waves, and make the most of your trading journey!

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.