Fibonacci Trading in Forex: A Beginner’s Guide

In forex trading, strategies are like playbooks guiding traders to success. Among these strategies, Fibonacci stands out as a powerful tool, with the capacity to enhance traders’ decisions with mathematical precision. Let’s explore how Fibonacci trading transforms numbers into invaluable allies in the forex market.

What is Fibonacci Trading in Forex?

In Fibonacci, each number is found by adding the two numbers before it. Fibonacci levels come from a special number sequence where each number is the sum of the two before it. Traders may use these levels to guess where prices might pause or change direction.

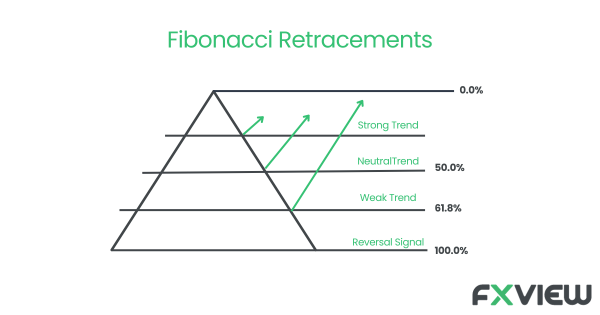

Traders also believe that these Fibonacci retracement levels can act as potential areas of support or resistance, where the price might reverse or consolidate before continuing in the direction of the initial swing. The rationale behind this is that market participants who are aware of these levels may place buy or sell orders in anticipation of price reacting to them.

The most commonly used Fibonacci trading in Forex are 38.2%, 50%, and 61.8%. These levels are drawn by identifying a significant price move (swing) on the chart and then measuring the retracement (correction) of that move. The retracement levels are calculated by multiplying the length of the swing by each of the Fibonacci ratios (0.382, 0.5, and 0.618) and then measuring the resulting levels from the swing’s high or low point.

Traders may combine the Fibonacci retracement levels with other technical analysis tools and indicators to indicate potential trade setups.

How to use Fibonacci Trading in Forex?

- Identify a Swing: First, you need to identify a significant price swing on the chart. This can be a move in either direction, upward (bullish) or downward (bearish). Look for a clear and distinct price move with a well-defined high and low point.

- Draw Fibonacci Retracement Levels: Once you have identified the swing, you may use a Fibonacci retracement tool available on most trading platforms to draw the retracement levels. The tool will automatically calculate the key Fibonacci ratios (38.2%, 50%, and 61.8%) for you. Start the tool at the highest point of the swing and pull it to the lowest point.

- Identify Potential Entry Levels: The retracement levels may act as potential support or resistance levels. Look for price reactions or consolidation around these levels. Traders may consider entering buy positions near the support levels (38.2%, 50%, or 61.8%) during an uptrend, or sell positions near the resistance levels during a downtrend. This is done in anticipation of the price reversing and continuing in the direction of the original swing.

- Combine with Other Technical Analysis Tools: Fibonacci trading in Forex can be used in combination with other technical analysis tools and indicators. Check for other factors such as moving averages, trend lines, or candlestick patterns that match up with the Fibonacci levels.

- Set Stop-Loss and Take-Profit Levels: Determine appropriate stop-loss and take-profit levels for your trades. Stop-loss orders could be placed beyond the Fibonacci levels to account for potential price fluctuations. Take-profit levels can be set at the next significant resistance or support level or based on your desired risk-reward ratio.

- Monitor Price Action: Once you enter a trade based on Fibonacci levels, monitor the price action closely. Observe how the price reacts around the levels and make adjustments to your strategy if necessary. If the price breaks through a key level, it may indicate a potential trend continuation or reversal, requiring you to reassess your trade.

Remember, Fibonacci patterns are just one tool in a trader’s arsenal. Mix them with other methods, be smart about risks, and think about the market mood in order to make informed decisions.

Advantages of Fibonacci Trading in Forex

Using Fibonacci trading in forex market can offer potential benefits to traders. Here are some of the advantages:

- Identifying Potential Support and Resistance Levels: Fibonacci retracement levels can help identify potential support and resistance levels in the price chart. These levels may act as zones where price reversals or consolidations may occur. Traders may look at these levels to decide when to jump in or out of a trade.

- Objective Tool: Fibonacci retracement levels are objective tools that can be applied uniformly to any price chart. Traders may use special numbers from the Fibonacci sequence to make sense of price changes. This might give them an indication to make decisions without just guessing.

- Popular Among Market Participants: Fibonacci levels are widely known to traders and market participants. Traders may place buy or sell orders near these levels, leading to potentially increased buying or selling pressure and potential price reactions.

- Combining with Other Analysis Techniques: Fibonacci patterns can be used in conjunction with other technical analysis tools and indicators. Traders may combine Fibonacci retracement levels with trend lines, moving averages, or candlestick patterns to assist trade setups or indicate merging zones where multiple factors align.

- Risk Management: Fibonacci levels can also be utilized for setting stop-loss orders. Traders may place their stop-loss orders slightly beyond key Fibonacci levels to account for potential price reactions. This way, traders may limit potential big losses.

- Timeframe Versatility: Fibonacci trading in forex can be applied across various timeframes, making them adaptable for different trading styles. No matter your trading style, Fibonacci levels can help indicate trade potential. But remember, while they’re useful, you’ve got to use them right. Always think about the market mood and how much risk you can handle.

However, as with any trading strategy or tool, there are risks and disadvantages.

Disadvantages of Fibonacci trading in Forex

- Subjectivity: One of the main criticisms of Fibonacci tools is the subjectivity involved in drawing them. Determining the correct high and low from which to draw retracement or extension levels can vary from one trader to another.

- Self-fulfilling prophecy: Some argue that the reason Fibonacci levels may work is that they’re widely watched and respected by traders. So, if a large number of traders are looking at the same levels and acting upon them, they can become a self-fulfilling prophecy.

- Not foolproof: Fibonacci levels do not guarantee that the price will reverse or consolidate at those levels. Like any tool, they’re best used in conjunction with other forms of analysis.

- Lack of empirical evidence: While many traders swear by Fibonacci levels, there isn’t a lot of empirical evidence to suggest they have a statistical edge in predicting future price movements.

- Over-reliance: Relying solely on Fibonacci levels without considering other technical and fundamental factors can be a significant disadvantage. The best trading decisions are often made by considering a merge of different indicators and signals.

- Market conditions: In highly volatile or fundamentally driven markets, Fibonacci levels might not hold as well as in more technically driven markets.

- Multiple levels: Sometimes, there are multiple Fibonacci levels close to each other, which might lead to confusion about which level is the most significant.

- False signals: Just like any other trading tool, Fibonacci levels can and do produce false signals. Depending solely on them can lead to losses if other market factors aren’t considered.

- Not a standalone system: Fibonacci levels are tools, not systems. They should be a part of a more comprehensive trading strategy, not the strategy in and of itself.

- Complexity for beginners: For someone new to trading, understanding and correctly applying Fibonacci tools can be daunting. There’s a learning curve involved, and misuse can lead to bad trading decisions.

Key Takeaways

- Forex strategies are plans for trading currencies.

- Fibonacci patterns help identify support and resistance levels.

- Common Fibonacci levels include 38.2%, 50%, and 61.8%.

- Advantages include precise levels, popularity, and adaptability.

- To use Fibonacci trading in forex: identify swings, draw levels, set entry/exit points, and monitor closely.

- Practice and combine tools for smart trading decisions.

Conclusion

Fibonacci trading in forex empowers traders with a unique tool to decipher support, resistance, and market direction. Combining Fibonacci with other strategies enhances their trading arsenal, granting them a competitive edge in navigating the dynamic financial waters. It’s the key to unlocking trading success in an ever-evolving market landscape.

Disclaimer: The information in this article is provided for educational and informational purposes only and is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.