Discipline and Patience in Trading

As any seasoned trader will tell you, potential success in the market is not just about having the right strategy, it’s also about developing two essential qualities- Discipline and Patience in Trading. Get ready to delve deep into understanding the importance of discipline and patience in trading and how cultivating the right trading mindset may lead to potential outcomes.

Discipline

In trading, discipline refers to the ability to stick to your trading plan and rules consistently. It means avoiding impulsive decisions driven by emotions and following a systematic approach which may help you manage risks and secure potential benefits. A disciplined trader can control their impulses, maintain focus, and doesn’t let emotions cloud their judgment.

To exemplify discipline in action, let’s consider a scenario. Imagine someone had a series of successful trades, and starts feeling overconfident. Instead of adhering to their risk management strategy, they increase their position size significantly on a high-risk trade, hoping for even larger profits. However, the market turned against them, and suffered significant losses due to their lack of discipline.

Patience

Patience, in the context of trading, is the ability to wait for potential opportunities and not rush into trades out of fear of missing out (FOMO). A patient trader understands that the market may offer potential opportunities, however trying to catch every single one may lead to poor decision-making. Being patient involves waiting for potential, ensuring it aligns with your trading strategy, and entering trades with a calm and composed mindset.

Consider a situation where you’ve been eyeing a particular stock for a while, but it hasn’t shown any significant movement. A patient trader may wait for the stock’s price to reach a level that aligns with their analysis and entry criteria. On the other hand, an impatient trader might jump into the trade prematurely, increasing the chances of losses.

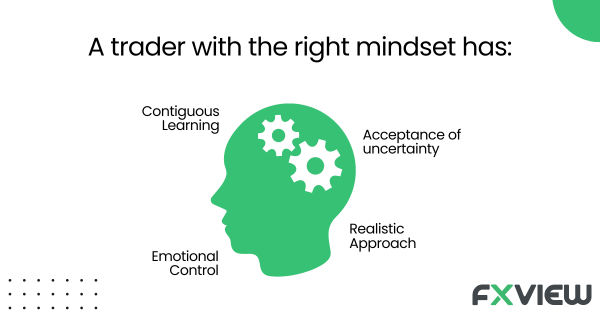

What could be considered as the Right Trading Mindset?

To achieve discipline and patience in trading, it’s crucial to cultivate the right trading mindset. Here are some key attributes of a trader with the right mindset:

- Realistic Expectations: Remember, trading isn’t a fast or easy way to get rich. Set achievable goals learn to take both potential profits and losses in your stride and always consider whether you can afford the losses.

- Emotional Control: Develop the ability to manage emotions like fear and greed. Emotions can make us act without thinking, causing poor decisions. Always take your time to evaluate the situation and make informed decisions.

- Acceptance of Unpredictability: Recognize that the market is unpredictable, and not every trade can lead to potential.

- Continuous Learning: Stay curious and committed to learning. Markets evolve and traders should adapt to changing conditions.

- Confidence, Not Overconfidence: Confidence is vital, but overconfidence can be detrimental. Base your decisions on solid analysis and data.

How to Trade with Patience?

Trading with patience involves a series of deliberate actions that may help you maintain discipline and wait for potential opportunities.

- Stick to Your Trading Plan: You may have a well-defined trading plan with clear entry and exit rules. Follow it, avoiding deviations based on emotions or market noise.

- Set Realistic Targets: Avoid chasing unrealistic profit targets that may lead you to take unnecessary risks. Aim for consistency and set potentially achievable goals each time.

- Use Stop-Loss Orders: Implement stop-loss orders which may help protect your capital from significant losses. This practice can ensure you exit a losing trade before it erodes your account.

- Avoid Overtrading: Limit the number of trades you take per day or week. Overtrading can lead to fatigue and reduce the quality of your decisions.

- Wait for Indication: Before entering a trade, you may wait for signals from technical indicators, price action, or fundamental analysis.

How to Improve Discipline in Trading

Improving discipline is an ongoing process that requires dedication and self-awareness. Here are some practical tips that may help you enhance your trading discipline:

- Maintain a Trading Journal: Keep a detailed record of all your trades, including entry and exit points, reasons for the trade, and emotional state. Keep looking at your journal to find potential ways to get better.

- Analyze Your Mistakes: Accept that mistakes are a part of trading. Instead of dwelling on losses, analyze what went wrong and how you can avoid similar errors in the future.

- Create a Trading Routine: Establish a daily routine that includes pre-market analysis, own research performance, setting alerts, and sticking to your plan. A structured routine may help you stay focused and avoid distractions.

- Take Breaks: Trading for extended periods can lead to fatigue and reduced discipline. Take regular breaks to clear your mind and maintain a fresh perspective.

Now that we’ve unpacked the significance of discipline and patience in trading, let’s dive into some pivotal takeaways.

Key Takeaways-Discipline and Patience in Trading

- Discipline in trading means consistently sticking to rules and avoiding emotion-driven decisions.

- Patience ensures waiting for the right opportunities, reducing impulsive trades.

- Cultivate a trading mindset with realistic expectations, emotional control, continuous learning, and balanced confidence.

- To trade patiently, adhere to your plan, set achievable targets, use stop-loss orders, avoid overtrading, and wait for clear signals.

- Boost discipline by maintaining a trading journal, analyzing errors, having a consistent routine, and taking breaks.

- Trading is a long-term journey, with discipline and patience being vital navigational tools.

Conclusion

Discipline and patience in trading are essential keys that can help you build your trading plan. By understanding the importance of following a trading plan, exercising emotional control, and waiting for potential opportunities, you may improve your trading strategy. Cultivating a smart trading mindset and continuously honing your discipline may lead you on the path to improving your trading strategy. Remember, embracing discipline and patience in trading can help you navigate the markets with confidence and composure.

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.