AI Trading in 2025: A Breakthrough for Traders

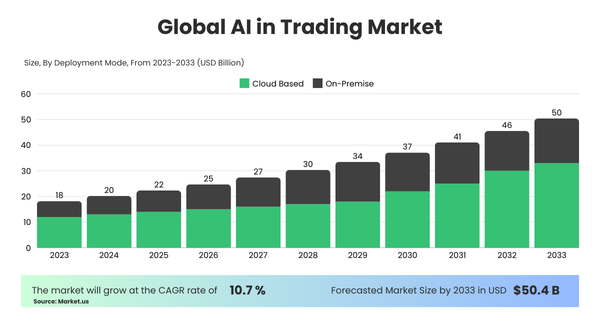

In recent years, AI has revolutionised trading and has taken a significant role in reshaping the market. In 2023, the Global AI trading market was worth USD 18.3 Billion and is expected to be worth around USD 50 Billion by 2033.

What is AI Trading?

AI trading includes analysing financial data and making trading decisions by using machine learning and algorithms. By identifying trends in market prices, volumes, and indicators, these AI algorithms offer insights that people would miss. It includes algorithmic trading, in which trades are made according to preset standards that AI modifies in real time. The key benefit is AI’s speedy analysis of big data sets, which allows for quicker and better-informed judgements and frequently outperforms human traders.

How AI Trading Works?

AI Trading operates through various stages, starting with data collection and then moves to decision-making and execution as follows

- Data collection: The AI starts by compiling a large amount of historical data on economic indicators, interest rates, stock prices and other metrics. For up-to-date analysis, advanced platforms may integrate real-time data sources.

- Evaluation: After collecting the data, it is evaluated using algorithms that search for patterns and trends, often utilising deep learning models that forecast future price movements.

- Decision making: This analysis is then used by the AI to determine whether to buy, sell or hold onto assets.

- Execution: Algorithmic trading completes trades in milliseconds by automatically executing transactions according to predetermined criteria.

- Learning & development: The AI model gradually improves its approach to become more accurate and efficient by learning from fresh data and past choices.

- Feedback loop: Through a feedback loop, this ongoing learning and development, particularly in reinforcement learning, enhances the AI’s capacity for making decisions.

Which AI is Best for Trading?

Choosing the ideal AI trading platform or tool depends upon the trader’s needs, goals and preferred market. The top AI trading platform in 2025 includes features such as learning algorithms, natural language processing, and real-time analytics. Some AI options to include machine learning models that examine past data to find trends and forecast future price movements are among the AI possibilities. Neural networks, decision trees, or support vector machines may be used in this.

Natural Language Processing (NLP) algorithms are an additional option for traders interested in unstructured data, such as news articles and social media, which are utilised to determine particular stocks or sectors.

By learning via trial and error in a simulated environment and gradually improving trading strategies, reinforcement learning models are becoming more and more popular for complicated, high-frequency trading activities.

Custom AI trading bots, which let users select particular parameters and strategies, are a popular option for people who want a hands-on approach.

Are AI Bots Legal?

Although laws differ by nation, AI trading bots are permitted in the majority of nations. The Securities and Exchange Commission (SEC) and other regulatory bodies have established financial rules that AI trading bots in the U.S. must follow. Traders should always make sure that local regulations are followed when engaging in algorithmic trading.

Despite the fact that AI trading is lawful in and of itself, certain practices like high-frequency trading have come under attention because that can jeopardise the stability of the market. Transparency and the possibility of market manipulation are two ethical factors that are becoming more and more important, now included in the legal framework.

Benefits and Challenges of AI Trading in 2025

- Speed & efficiency: AI executes deals in milliseconds This is especially useful in high-frequency trading conditions.

- Data-driven decision-making: Since AI trading bots can process enormous volumes of market data to make more accurate conclusions.

- 24×7 monitoring: Traders can keep an eye on markets 24/7 with AI trading, which is particularly helpful for cryptocurrency markets.

- Reduced mistakes: AI also reduces mistakes that could result from human emotions or poor judgement by automating exchanges.

However, despite its advantages AI trading has drawbacks including hefty upfront fees that may be unaffordable for small traders.

Moreover, AI models could also struggle in volatile markets where forecasts may lose their accuracy. Furthermore, AI trading mostly depends on past data, which might not always be a reliable indicator of future market circumstances.

Conclusion

All things considered, AI trading in 2025 is revolutionising the way people approach the stock and cryptocurrency markets. It is a potent fusion of money and technology, presenting both new possibilities and difficulties. In an increasingly complex market environment, traders can use AI trading to make faster, more intelligent decisions by being informed and choosing the right platform.

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment, or trading advice. You should not make any financial, investment or trading decisions based on the information provided in this article without performing your own research or seeking advice from an independent advisor.