Trump Project 2025: A Turning Point or Nightmare for Traders?

Recent discussions about Trump Project 2025 have sparked debates regarding its potential market impact. The policies outlined in the project could either present significant opportunities for traders or introduce considerable challenges.

Key Takeaways for Traders

- Volatility: Sweeping reforms under Trump Project 2025 may trigger market instability, necessitating preparation for sudden price fluctuations.

- Tax Cuts: While tax reforms might boost short-term market growth, they could also lead to long-term fiscal uncertainty.

- Trade Tariffs: New tariffs may result in unpredictable movements in currency and commodity markets, creating both risks and opportunities.

- U.S. Dollar & Gold: A weakening dollar could reshape global markets, with gold potentially seeing increased demand as a safe-haven asset amid inflation and trade tensions.

- Bitcoin: If the dollar weakens and global uncertainty rises, Bitcoin might gain traction, attracting institutional interest.

What is Trump Project 2025?

Trump Project 2025 outlines Donald Trump’s vision for his second presidential term, with proposed changes in healthcare, education, and employment. For traders, the most significant aspects involve potential shifts in government spending, tax laws, and economic regulations, which could have far-reaching effects on market dynamics.

How Could Trump Project 2025 Affect Traders?

The implementation of Trump Project 2025 policies could create a volatile market environment. Below are key elements of the proposal and their potential impact on traders:

Government Spending Cuts

A key objective of Trump Project 2025 is reducing government spending. While this may help address national debt, it could also lead to political unrest, particularly if funding cuts affect public services like education and healthcare. Such unrest could drive volatile market movements, which traders must anticipate.

Tax Reforms and Economic Impact

Business-focused tax cuts form another critical element. While these may boost short-term corporate profits, they raise questions about long-term fiscal stability. Additionally, speculation about dismantling the Federal Reserve could introduce significant uncertainty in bond and currency markets, exacerbating volatility.

Trade War and Tariffs

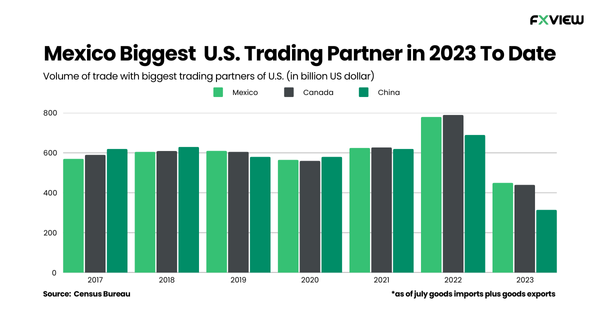

The proposal’s emphasis on trade policy, including potential tariff increases and trade restrictions with key partners like China, Canada, and Mexico, could have a profound impact on global markets. Such moves may disrupt supply chains, driving up commodity prices and increasing market volatility. Traders dealing in commodities like gold and oil should closely monitor these developments.

Impact on the U.S. Dollar (USD) and Gold

Spending cuts and potential deficits from tax reductions may weaken the USD, creating fluctuations in major currency pairs. A weaker dollar often correlates with higher gold prices, as gold is seen as a safe-haven asset. Traders could benefit from these trends by closely observing USD and gold performance.

Bitcoin (BTC) and Digital Assets

Although cryptocurrencies are not explicitly mentioned in Trump Project 2025, any shifts in U.S. trade laws or regulations could affect Bitcoin. In times of economic uncertainty or a weakening dollar, Bitcoin might attract more institutional investors. Its growing status as a store of value could provide traders with new opportunities in a volatile environment.

Conclusion: A Turning Point or a Nightmare?

Trump Project 2025 could represent a pivotal moment for markets, with its focus on tax cuts, government spending reductions, and employment reforms likely to provoke varied reactions. While some traders might welcome the opportunities created by these policies, others may view the potential for long-term instability as a significant challenge.

Staying informed and adaptable will be essential for traders as they navigate the potential market shifts brought about by these sweeping changes.

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.