Santa Claus Rally 2024: Turning Volatility into Financial Cheer for Traders

The Santa Claus Rally is a historical phenomenon observed in financial markets, where the final week of December and the first two trading days of January often experience bullish momentum. This trend is attributed to factors such as year-end market adjustments, lower trading volumes, and holiday-induced optimism. For traders, understanding this pattern provides an opportunity to navigate volatile markets and capitalize on seasonal trends.

Key Takeaways

- The S&P 500 averages a return of 1.3% during this period, with some years showing stronger gains.

- Bitcoin exhibits higher volatility and unpredictability, with significant losses like -21.30% in 2017 but notable rallies in other years.

- Indices, consumer discretionary stocks, and commodities (e.g., gold and oil) often perform well during this period.

- Successful trading relies on risk management, strategic planning, and an understanding of asset behavior.

Will There Be 2024 Santa Claus Rally?

Several factors could influence the possibility of a Santa Claus Rally in 2024:

- Economic Conditions:

A robust economy with controlled inflation increases the likelihood of a rally.

In Q3 2024, the U.S. economy grew at an annualized rate of 3.1%, supported by strong consumer spending and easing inflation. - Market Sentiment:

Investor optimism drives the Santa Claus Rally. Currently, 40.7% of investors report bullish sentiment, exceeding the historical average of 37.5% (AAII).

Global fund managers are showing significant exposure to U.S. stocks, reflecting a strong risk-on environment. - External Factors:

Geopolitical events and global economic disparities could impact market performance.

For instance, while the U.S. economy grows, the eurozone faces a slowdown (S&P Global), potentially creating divergent market dynamics.

Historically, Santa Claus Rallies are more likely during periods of positive investor sentiment and minimal external disruptions. However, the market’s inherent unpredictability remains a key consideration.

Historical Data: S&P 500 and Bitcoin

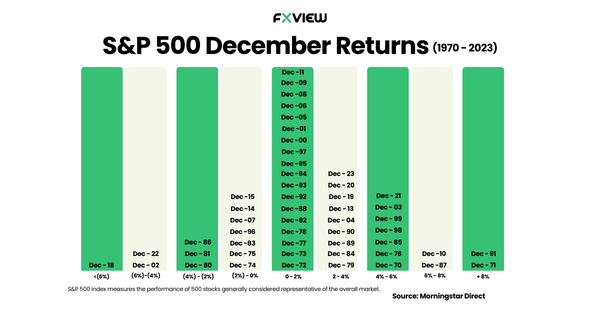

S&P 500: Decades of Positive Trends

- The S&P 500 consistently shows gains during this period, with an average return of 1.3% since 1950.

- 2020: A 3.6% gain as markets rebounded from pandemic-induced declines.

- 2018: A rare decline of -10.7%, driven by interest rate concerns and trade tensions.

Bitcoin: A Volatile Contender

Bitcoin, the flagship cryptocurrency, often mirrors broader crypto market behavior but with much higher volatility.

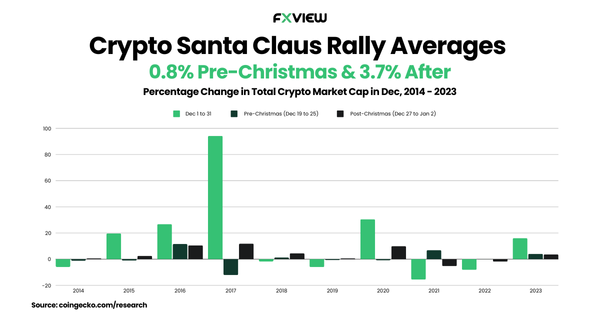

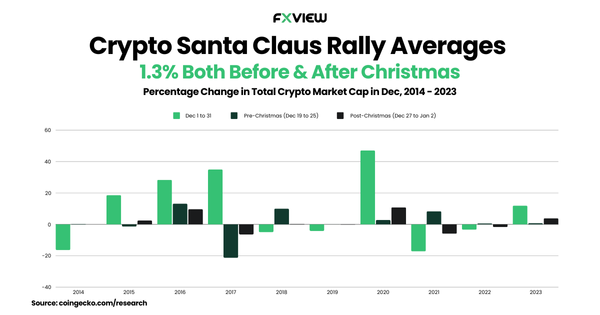

Key Trends in the Crypto Market

- Post-Christmas Rally

Frequently observed, with notable increases like a 10.56% gain in 2016. - Pre-Christmas Rally

Less frequent but significant, with an 11.56% rise in 2016. - Market Corrections

Non-rally years often see corrections, such as -12.12% in 2017 due to the ICO bubble bursting.

S&P 500 vs. Bitcoin: A Comparison

The Santa Claus Rally offers distinct opportunities across the S&P 500 and Bitcoin:

- S&P 500: A more consistent and predictable rally history attracts seasoned traders.

- Bitcoin: The cryptocurrency’s high volatility presents both risks and opportunities, appealing to traders seeking larger potential returns.

To successfully navigate the Santa Claus Rally, traders must prioritize strategic planning, risk management, and a comprehensive understanding of the market landscape. While past trends provide valuable insights, they are not guarantees of future performance.

Trading Strategies for 2024

- Diversify Assets:

Combine relatively stable assets like indices and gold with higher-risk options like Bitcoin. - Implement Risk Management:

Use stop-loss orders, position sizing, and diversification to mitigate potential losses. - Monitor Market Sentiment:

Stay informed about investor optimism, geopolitical developments, and macroeconomic trends. - Take a Long-Term Perspective:

Seasonal patterns are useful, but understanding long-term market behavior is crucial, especially for volatile assets like Bitcoin.

Conclusion

The Santa Claus Rally offers traders unique opportunities across traditional and crypto markets. The S&P 500 appeals to those seeking consistent and predictable returns, while Bitcoin’s high volatility attracts risk-tolerant investors aiming for outsized gains. Traders should focus on careful planning, effective risk management, and diversification to navigate these seasonal trends and maximize returns.

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.