Navigating Geopolitical Events: How Will They Amplify Forex Trading Risks in 2025?

The Forex market is the largest financial market in the world, with an average daily trading volume of $6.6 trillion. It is highly dynamic and influenced by numerous factors, such as geopolitical events, central bank policies, and economic indicators.

Why Do Geopolitical Events Matter?

A geopolitical event is any political, economic, or social event that affects a region or the globe. These include natural disasters, trade talks, elections, economic policies, conflicts, and sanctions. Such events can cause increased volatility and disrupt market stability. For instance, a sudden trade ban or a political revolt in a nation could lead to significant fluctuations in the value of its currency.

Geopolitical Events to Watch in 2025

Several geopolitical events in 2025 are expected to influence the current market, presenting both opportunities and challenges for traders:

- Tensions in the Middle East and OPEC+ Dynamics

The Middle East remains critical for global energy and geopolitical stability. OPEC+ has delayed planned oil production hikes to mid-2025 in an effort to balance supply and demand amid uncertainties. However, any regional instability could lead to oil price fluctuations, directly impacting currencies tied to energy exports, such as the Norwegian krone (NOK), Russian ruble (RUB), and Canadian dollar (CAD). Traders should closely monitor OPEC+ policies and regional developments to manage forex risks effectively. - US Presidential Administration

Geopolitical tensions are likely to escalate when Donald Trump begins his second term in January 2025. The current US-China trade war is expected to intensify, particularly with the announcement of an additional 10% tariff on Chinese goods. These new tariffs are expected to pressure the yuan (CNY) and affect currencies of China’s main trading partners, including the Japanese yen (JPY) and the Australian dollar (AUD). Additionally, renegotiations of USMCA agreements could disrupt trade with Canada and Mexico, potentially impacting the Canadian dollar (CAD) and Mexican peso (MXN) - EU and UK Relations Post-Brexit

Trade and economic policies are still evolving after Brexit. Disagreements over trade agreements or regulatory differences between the EU and the UK could affect the euro (EUR) and British pound (GBP). As the EU faces ongoing economic challenges, traders should watch for any significant policy changes by the European Central Bank (ECB). - Russia-NATO Tensions

One of the biggest geopolitical threats in 2025 remains the ongoing conflict between Russia and Ukraine. Global market volatility continues to rise due to Russia’s response to economic sanctions and NATO’s financial and military assistance for Ukraine. Disruptions in the energy sector also affect currencies tied to gas and oil exports, with the Russian ruble (RUB) under constant pressure. - Canada’s G7 Presidency

Canada’s assumption of the G7 presidency in January 2025 could lead to increased attention on economic policies, particularly regarding energy security and trade regulations. This development could bring more focus to the Canadian dollar (CAD) as significant events unfold in Canada. Additionally, Canada’s diplomatic relationship with the US, particularly under President Trump, may have lasting impacts on trade dynamics. - Emerging Market Debt Concerns

Localized geopolitical instability and rising debt levels in emerging markets will likely make currencies like the Argentine peso (ARS), South African rand (ZAR), and Turkish lira (TRY) more vulnerable. These threats could lead to increased currency devaluation and capital loss.

How Geopolitical Events Impact Forex Markets

Geopolitical events can disturb the forex market in several ways:

- Currency Volatility

Political unrest or foreign conflict can lead to significant fluctuations in the currency of the affected country. For instance, when investor confidence declines during major geopolitical crises, the currencies of the impacted countries often depreciate. - Safe-Haven Demand

During periods of geopolitical instability, traders tend to shift capital to safe-haven currencies, such as the US dollar (USD), Swiss franc (CHF), and Japanese yen (JPY). This shift can lead to volatility in currency pairs. - Central Bank Policies

In response to geopolitical events, central banks may adjust their monetary policies, which in turn affects interest rates and currency values. For example, a central bank may lower interest rates to stimulate the economy during a geopolitical conflict. - Trade Relations

Events such as trade wars or new trade agreements can greatly influence market shifts. For example, increased tariffs between major trading partners can harm export-driven economies, leading to currency depreciation. - Market Sentiment

Forex markets are also influenced by traders’ perceptions of geopolitical risks. While uncertainty may lead to currency depreciation, optimism regarding peace treaties or the resolution of trade disputes can contribute to currency appreciation.

Strategies for Managing Geopolitical Risks in Forex Trading

Although geopolitical risks cannot be entirely eliminated in the Forex market, traders can take certain actions to mitigate these risks:

- Keep Up with Reliable News Sources

Stay informed through reliable news sources to track geopolitical events. Being well-informed helps traders anticipate market movements and adjust their strategies accordingly. - Diversify Your Portfolio

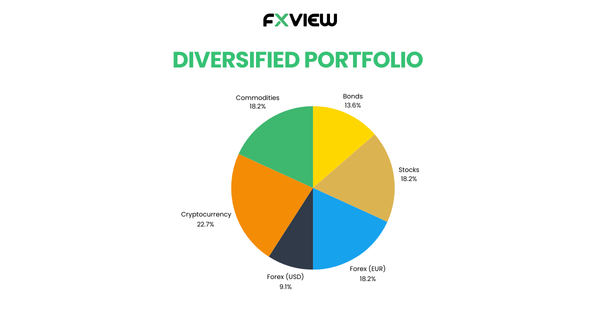

To reduce the impact of geopolitical risks, diversify investments across various assets or currencies. Diversification can mitigate some risks, though it cannot completely eliminate them.

- Use Stop-Loss Orders

Implement stop-loss orders to protect your investments by automatically closing trades at predetermined levels to minimize potential losses. - Reduce Exposure to High-Risk Currencies

Be cautious when trading currencies from economies with high levels of geopolitical instability. This reduces the risk of unpredictable market fluctuations due to unrelated geopolitical events. - Hedge Your Positions

Use hedging strategies to protect against adverse market movements caused by geopolitical events. Hedging can help establish clear profit and loss limits, allowing traders to protect gains and limit losses if currency movements fall outside of a set range. - Combine Fundamental and Technical Analysis

Use a combination of technical indicators and fundamental analysis to forecast market movements. Economic indicators and geopolitical developments are often intertwined, helping traders make more informed decisions.

Conclusion

Geopolitical events can have unpredictable effects on forex markets. Events such as elections, trade wars, conflicts, and economic policies present both opportunities and challenges for traders. To manage the risks in 2025, traders should diversify their investments to lower exposure and hedge their positions against large market fluctuations. By employing proactive strategies, traders can reduce uncertainty and protect their assets in volatile market conditions.

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.