5 Emerging Reasons That Could Impact Gold Rate in 2025

The gold rate is universally a hot topic among traders, especially as the year draws to a conclusion. With global markets fluctuating, there are several factors that can influence whether gold prices rise or fall in 2025. Let’s explore the key reasons behind potential dips or surges in gold prices.

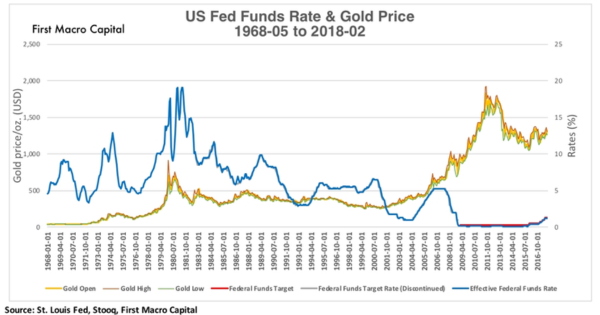

Federal Reserve Interest Rate Decisions

The U.S. Federal Reserve’s interest rate policy is a cornerstone of gold price dynamics. Historically, gold prices tend to rise when the Fed cuts rates and dip when rates are increased.

Recent speculation about the Fed pausing rate hikes has stabilized gold prices, though gold experienced its worst week since 2021. If the Fed adopts a dovish stance in 2025, gold could witness a surge, as traders often turn to gold as a safe-haven asset during economic uncertainty.

Impact of the U.S. Dollar on Gold Rates

The relationship between the U.S. dollar and gold is critical. A stronger dollar makes gold more expensive for foreign buyers, typically causing a dip in gold rates.

For instance, recent Consumer Price Index (CPI) data strengthened the dollar, pushing gold to a two-month low. Conversely, a weakening dollar in 2025—possibly due to economic fundamentals or shifts in market sentiment—could make gold cheaper for international buyers, driving prices higher.

Additionally, if inflation remains elevated while the dollar depreciates, gold may be viewed as a hedge against the erosion of purchasing power, boosting its demand.

Inflation Trends

Gold is often regarded as a hedge against inflation. Rising inflation prompts traders to buy gold to protect against declining purchasing power. Conversely, low inflation could cause gold prices to dip.

For example, gold’s recent decline has been attributed to expectations of a robust U.S. economy and controlled inflation. Should inflation data in 2025 indicate an upward trend, gold prices might surge. However, if inflation remains low, it could temper its appeal as a protective asset.

Geopolitical Risks

Geopolitical tensions are another driver of gold price fluctuations. Gold demand often increases during periods of instability, such as military conflicts, trade wars, or political unrest.

In 2025, potential hotspots like the Middle East or Eastern Europe could trigger gold surges if tensions escalate. Conversely, a period of global peace might lead to reduced demand, causing prices to dip. Keeping an eye on international developments will be crucial for traders.

Market Sentiment and Economic Outlook

Market sentiment significantly impacts the gold rate. During times of economic uncertainty, investors often flock to gold as a safe haven.

For example, significant political events like unexpected election outcomes or economic shocks could increase volatility and drive up gold prices. On the other hand, a stable economic outlook and investor confidence in higher-yielding assets might lead to reduced demand for gold, causing its price to dip.

Conclusion: Is 2025 a Good Year to Trade Gold?

The gold rate in 2025 will likely be shaped by several factors, including Federal Reserve policies, the strength of the U.S. dollar, inflation trends, geopolitical developments, and market sentiment.

- Dip scenarios: A strong dollar, low inflation, or reduced geopolitical tensions.

- Surge scenarios: Rate cuts, rising inflation, or heightened geopolitical risks.

Understanding these dynamics will be key to navigating gold price trends in 2025. Whether the market dips or surges, informed trading decisions can turn opportunities into profits.

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment, or trading advice. You should not make any financial, investment or trading decisions based on the information provided in this article without performing your own research or seeking advice from an independent advisor.